Gucci’s luxurious Snake Ace Embroidered Sneakers, Tencent’s addictive PUBG, Netflix’s disruptive streaming platform, Amazon’s world-largest e-commerce platform, and Facebook’s potential libra currency are merely a few products under Baillie Gifford’s Long Term Global Growth Portfolio’s holdings. Baillie Gifford’s key to success is acquiring these companies into its portfolio before they become “the” companies they are now.

ONE-UGG, a fund from ONE-Asset Management in Thailand, acts as Baillie Gifford’s Long Term Global Growth (LTGG) Investment Fund’s feeder fund, allowing Thais to invest in LTGG. LTGG invests globally in long-term growth equity that has potential to grow multiple fold.

What makes Baillie Gifford stand out is their unique company culture and approach. Unlike many Thai asset management firms with one fund manager, LTGG’s portfolio holdings and decision making are determined by an investment team, composed of 7 members. These members have an average experience of approximately 15 years at Baillie Gifford. With education backgrounds ranging from philosophy, politics and economics to computer science and history, the team members are able to offer different valuable perspectives at the discussion table. The team runs through a series of 10 stock research framework questions before deciding to buy, hold, or sell a stock:

- Is there room to double sales in the next five years?

- What happens over ten years and beyond?

- What is your competitive advantage?

- Is your business culture clearly differentiated? Is it adaptable?

- Why do you customers like you? Do you contribute to society?

- Are your returns worthwhile?

- Will they rise or fall?

- How do you deploy capital?

- How could it be worth five times as much or more?

- Why doesn’t the market realise this?

Without a central figure, like a sole fund manager, bias could be reduced. The process of exchanging thoughts and opinions under a framework equips the LTGG team with both qualitative and quantitative information to base their decision on. Dr. Andrew Stotz, CEO of A.Stotz Investment Research, wrote, “the only law in finance is that there are no laws of finance.” Similarly, the LTGG team combines multiple questions, approaches, ideas, and opinions to frame their portfolio, allowing them to buy the stocks-of-tomorrow today.

Another interesting aspect that the LTGG team takes into consideration when making a decision to buy a company is good decision making and governance. For example, Hermès was favoured over another French luxury brand because over 70% of its equity is held by the Hermès family; this allows them to make good management decisions in tough times. In the instance of good governance, Alibaba, one of LTGG’s holdings, cares about gender diversity, having a fifty-fifty male to female split in the workforce. Further, Alibaba annually holds a talent-search program to recruit individuals from around the globe. Indeed, culture is a competitive advantage.

Scattered across the globe are LTGG analysts, who are sent to explore business opportunities early on in different emerging market countries. One team member travelled to Indonesia to analyze how ride hailing service apps, Grab and GO-JEK, are reaping benefits from Indonesia’s notorious traffic congestion and are competing to become the next super-app in the region. Another analyst departed for Africa to explore Zipline and Jumia. Zipline, a company based in Rwanda, is a medical delivery business that employs drones to deliver medical supplies over rough and unfavorable terrain.

Zipline (Source: CNBC.com)

Jumia is an e-commerce marketplace, which matches businesses and consumers; e-commerce is advantageous in Africa because it is more convenient than the alternative of going to malls due to inefficient transportation. Meanwhile, a different analyst went to Brazil to review a newly-listed company called Stone; Stone provides financial solution to merchants, giving them the ability to accept credit cards and other forms of payments. While many of these companies are still private, LTGG is already building relationships with the company by getting to know them properly. This will allow LTGG to potentially invest in these companies once further favourable developments occur.

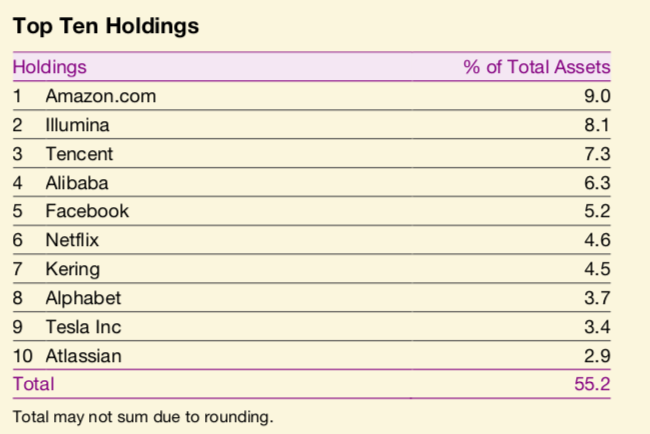

LTGG’s Top Ten Holdings as of 31 May 2019 (Source: Baillie Gifford)

When looking at LTGG’s portfolio, people see a concentration of companies, for example, listed in the United States or China. This could lead to fear of concentration risk. However, this may not be a concern for companies that receives revenue from multiple countries. LTGG does not care where companies are headquartered or listed because location does not necessarily imply how a company will perform, operate, and obtain revenue. Because of globalization and interconnected global supply chains, revenue for a company based in one country can come from many countries around the world. For example, Hermès’ revenue from China rivals that of its home country, France. Sweden’s Spotify earn a substantial amount more from the US than its home markets. United States’ NVIDIA derives four times more sales from China and Taiwan than it does from North America. For the LTGG portfolio, revenues earned from North America, Europe, and Asia were 39%, 15%, and 43% respectively.

While LTGG does not believe in the concept of “sectors,” they accept the notion of “themes.” Themes refer to megatrends such as the transition from sports to e-sports, malls to e-commerce platforms, pharmaceuticals to genetics, and information to data. A “theme” that many investing houses have been talking about is emerging markets. While developed countries are slowly reaching aging societies, many of the emerging markets still have a large young workforce, powering the economy through consumption. LTGG is already ahead of the game, scouting companies that will become the “thing” of the future in emerging markets like Brazil, Indonesia, and Rwanda.

Though the upside potential for ONE-UGG, through its master fund LTGG, is high, investors should be ready to face high volatility. Baillie Gifford gives emphasis on long term growth, having an average holding of 8 years; thus, short term quarterly volatility will be ignored. However, stocks that underperform for an extended period of time will be reevaluated by the LTGG Team. With their unique approach to stock picking and passion for actively researching growth companies, LTGG is able to invest thematically in growth stocks that have both excellent company culture and decision making abilities at a very early stage.

For more information regarding ONE-UGG and BIC Technology, please visit:

https://www.one-asset.com/fund/detail/244/THB

https://finnomena.com/fund/ONE-UGG-RA

https://www.finnomena.com/bic/

Sources:

Baillie Gifford. “Looking Backward Going Forward.” Long Term Global Growth. April 2019: 1-56. Print.

Baillie Gifford. “One Asset Management Limited.” Long Term Global Growth. October 2018: 1-6. Print.

Stotz, Andrew. Valuation Mistakes & How to Avoid Them. Bangkok: Andrew Stotz, 2018. Print.

Jessada Sookdhis

Investment Analyst (IA)

ตรวจทานบทความ

คำเตือน

ผู้ลงทุนต้องทำความเข้าใจลักษณะสินค้า เงื่อนไขผลตอบแทน และความเสี่ยงก่อนตัดสินใจลงทุน | ผลการดำเนินงานในอดีตมิได้เป็นสิ่งยืนยันผลการดำเนินงานในอนาคต | ผู้ลงทุนอาจมีความเสี่ยงจากอัตราแลกเปลี่ยน เนื่องจากการป้องกันความเสี่ยงขึ้นอยู่กับดุลพินิจของผู้จัดการกองทุน | ผู้เขียนบทความนี้มิได้รับค่าตอบแทนหรือมีส่วนได้ส่วนเสียกับบริษัทที่กล่าวถึงในบทความนี้แต่อย่างใด | ข้อมูลและการคาดการณ์ที่ปรากฏในบทความนี้จัดทำขึ้นจากแหล่งข้อมูลในอดีตร่วมกับการวิเคราะห์ปัจจัยพื้นฐาน แต่ทั้งนี้ไม่อาจรับรองความสมบูรณ์แท้จริงและความแม่นยำของการวิเคราะห์ข้อมูลในอนาคตได้