เนื่องจากบทความนี้ มีเนื้อหาเกี่ยวกับการอัปเดตเรื่องการปรับพอร์ต ซึ่งต้องแจ้งอย่างทันการณ์ ทางฟินโนมีนาจึงขอเผยแพร่ฉบับภาษาอังกฤษก่อน

ท่านสามารถติดตามบทความฉบับภาษาไทยได้เร็วๆ นี้

- Celebrating 1 year of our All Weather Strategy with FINNOMENA!

- We’re in rough waters

- Review: Gold was the winner in the past three months

- Performance: All Weather Strategy has outperformed World equity

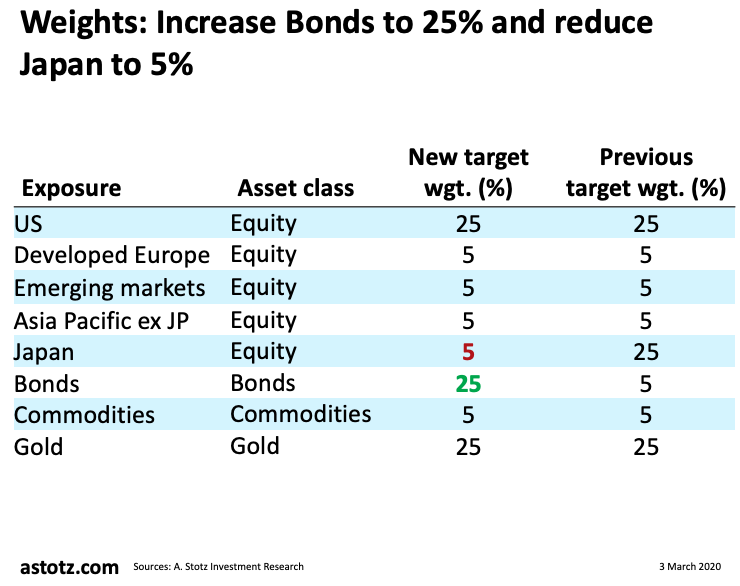

- Weights: Increase Bonds to 25% and reduce Japan equity to 5%

- Outlook: COVID-19 remains the biggest, but not the only concern

- Regional Equity FVMR Snapshot

Celebrating 1 year of our All Weather Strategy with FINNOMENA!

- The All Weather Strategy has now been up and running at FINNOMENA for 1 year

- We’re grateful for all the investors that have put the trust in our All Weather Strategy

- We’re also thankful for FINNOMENA offering us the opportunity to make the strategy available as a GURUPORT

We’re in rough waters

- The opening of 2020 has undoubtedly been rough for equity investors

- It’s not easy to sit still in the boat when the value of your portfolio falls massively in a day due to big drops in the stock market

- That’s why we created the All Weather Strategy; equity has had the highest long-term return, but the ride is bumpy, and we aim to cushion the downside by reducing the equity allocation at times

Review: It was all about COVID-19

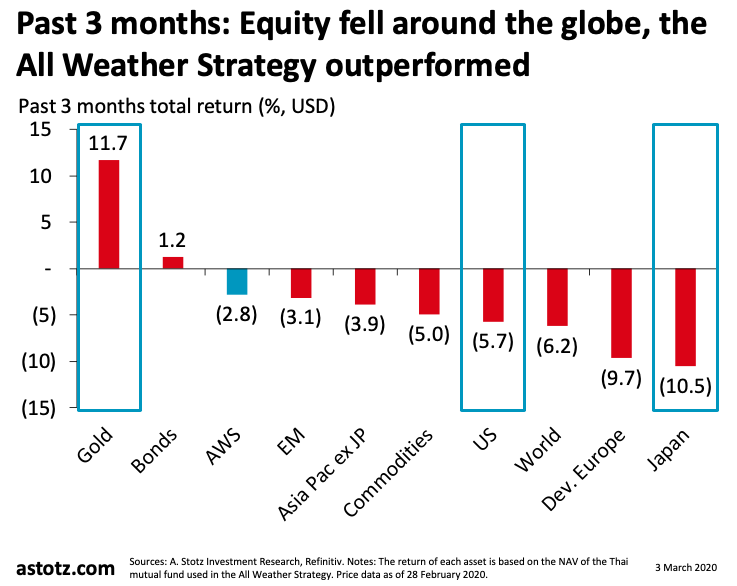

- In our rebalancing in December 2019, we increased the target allocation of Japan to 25% from 5%, which hurt the return as Japan was the worst performer in the past 3 months

- Japan’s GDP growth plunged in 4Q19, surprising the market, and the country has gotten closer to a recession

- At the same time, Japan is the country with the fifth-highest number of confirmed COVID-19 cases in the world

Review: Panic in equities and pessimism in commodities

- In total, we had a 65% target allocation to equity, US equity had a 25% allocation, and it was among the worst performers as well

- Commodities besides precious metals performed relatively poorly in the past 3 months as well

- Oil and industrial metals fell as the global growth outlook worsened

Review: Pandemic panic led investors to defensive assets

- As COVID-19 has led to falling equity markets across the board and falling prices in many commodities, defensive assets, gold and bonds, performed well in the past 3 months

- Gold price shot up in the past 3 months as panic spread in the markets, and it was the best-performing asset by far

Past 3 months: Equity fell around the globe, the All Weather Strategy outperformed

Past performance/ performance comparison relating to a capital market product is not a guarantee of future results.

- AWS: Outperformed World equity by 3.4%

- Gold: COVID-19 panic has pushed up the gold price

- US: Strongest in the Developed world

- Japan: Worst performer due to recession fears and COVID-19 outbreak

Since inception: The strategy has outperformed World equity

Past performance/ performance comparison relating to a capital market product is not a guarantee of future results.

- The All Weather Strategy had a 45% equity allocation from inception to September 2019, and 65% after that

- The high gold allocation has paid off recently as it has lowered the downside compared to an equity-only strategy

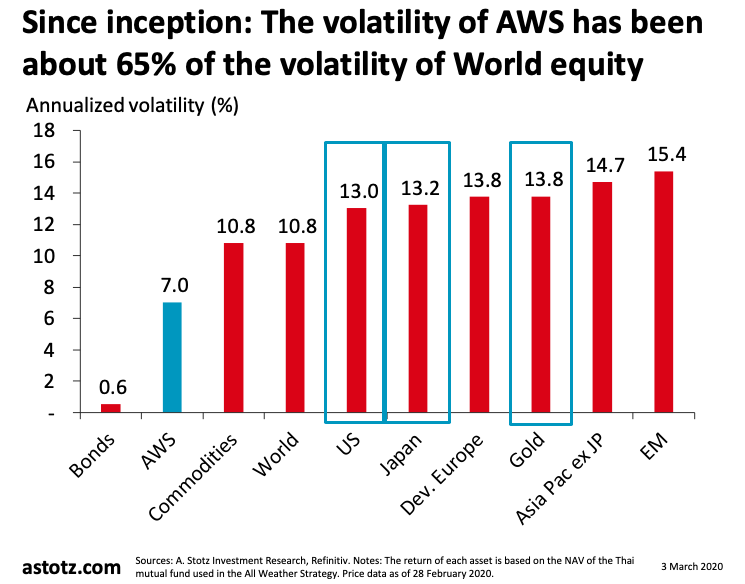

Since inception: The volatility of AWS has been about 65% of the volatility of World equity

- The volatility of AWS has been about 65% vs. the volatility of World equity

- 25% bond allocation until September 2019 has contributed to the low volatility of AWS

- As gold is uncorrelated to equity, it has dampened the overall AWS volatility

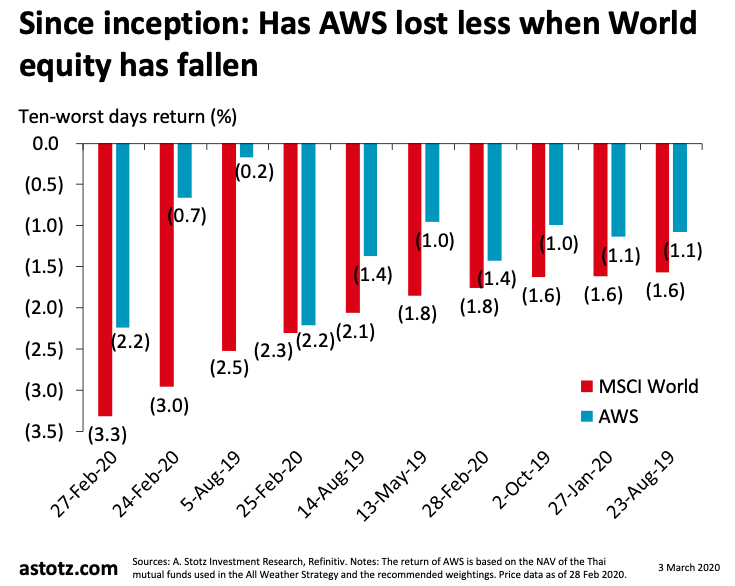

Since inception: Has AWS lost less when World equity has fallen

Past performance/ performance comparison relating to a capital market product is not a guarantee of future results.

- A key feature of AWS is that it aims to lose less when equity markets fall

- Looking at the 10 worst days of World equity since the inception of AWS, the has strategy has lost less on every day so far

- Much due to low equity weight and gold allocation

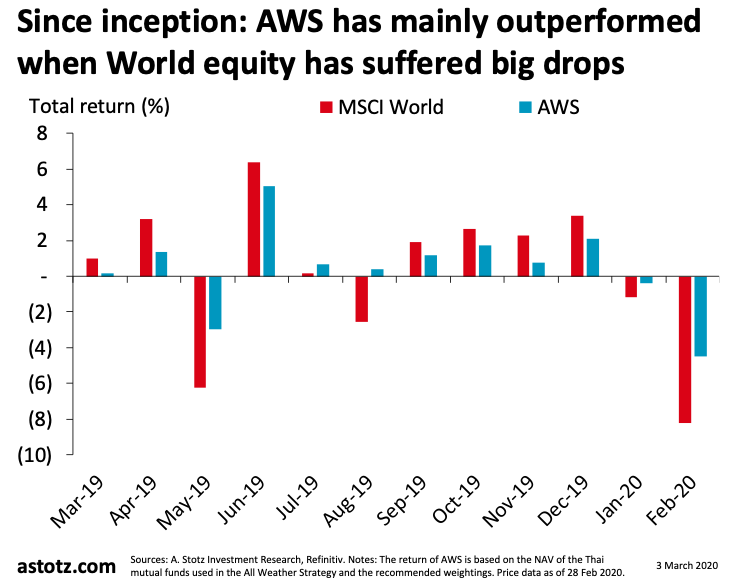

Since inception: AWS has mainly outperformed when World equity has suffered big drops

Past performance/ performance comparison relating to a capital market product is not a guarantee of future results.

- Largest outperformance has been in the months of Feb-20, May-19, and Aug-19 when World equity has fallen the most

- Gold and bonds served as an effective hedge in the two months in 2019, and gold worked as a hedge in Feb-20 as well

Weights: Increase Bonds to 25% and reduce Japan to 5%

- Equity down to 45%

- US equity remains at high valuations, but this is similar to a neutral weighting for the US within our equity allocation

- Gold and Bonds to serve as an effective hedge if equity markets continue to fall

Outlook: The market is sure the Fed is going to cut the rate at the March meeting

US gov’t debt and currency issues

- Positive for gold, risk for US market

Market now expects rate cuts in the US to stimulate the US economy

- Market-implied probability of 100% for the Fed to cut rates by 0.5% at the March meeting

Looking at corporates, fundamentals appear to have peaked which could lead to limited upside in equity

Outlook: It’s not all about COVID-19

- COVID-19 development is going to overshadow the impact from the US-China “phase one” trade deal

- Unrest in Hong Kong could worsen as protests seem to resume after a “Corona break”

- Geopolitical tensions between US and Iran remain, the conflict in Syria continues with Turkey and Russia as main players at the moment

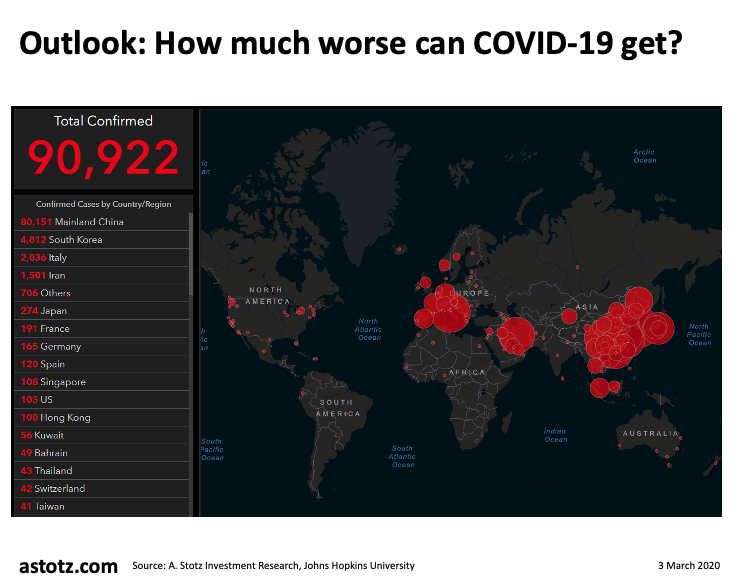

Outlook: How much worse can COVID-19 get?

In January, we said:

“If China can’t contain the coronavirus and it spreads to other countries, the global growth outlook could rapidly worsen”

- It’s now evident that COVID-19 couldn’t be contained within China, and we’ve seen equity markets react to that

- We also know that this virus outbreak has hit global GDP growth, the main question is: how much worse can it get?

Outlook: Global pandemic is possible, but not the only risk on the horizon

- Geopolitical tensions and the COVID-19 outbreak are negatives for the global growth outlook and equity

- If COVID-19 becomes a global pandemic, things can become a lot worse

- There’s always a risk of overreacting in times like this, but even if a global pandemic is avoided, there are still geopolitical tensions, peaking fundamentals, and high valuations left to overcome

Outlook: Focus on limiting the downside

- The All Weather Strategy aims to capture as much of the long-term equity return as possible, while also working to reduce the risk of an equity-only portfolio

- As such, we are comfortable to overweight defensive assets; gold and bonds

- Bond prices could be boosted by further rate cuts or larger-than-expected rate cuts

- Gold has historically offered a safe haven in tumultuous times and is uncorrelated to equity over time

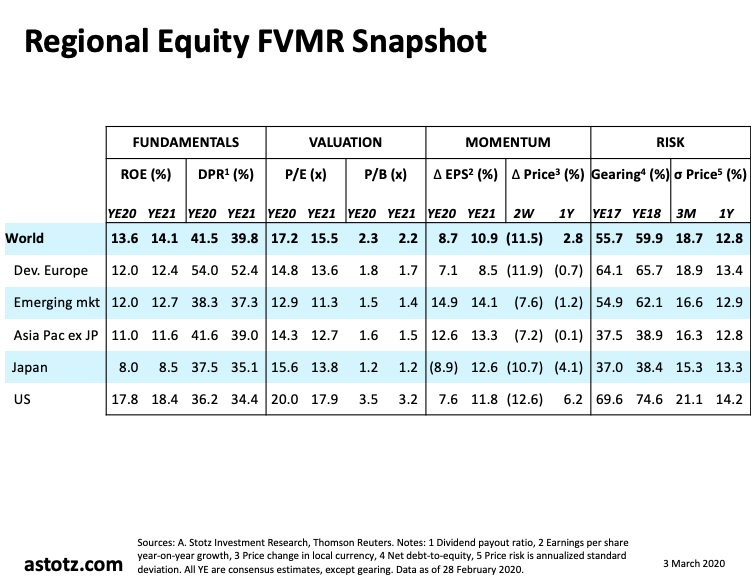

Regional Equity FVMR Snapshot

- Fundamentals: US has the highest ROE

- Valuation: Emerging markets and Japan trade at lowest multiples

- Momentum: Massive price drops in the past 2 weeks

- Risk: Lowest gearing in Asia Pacific ex JP and Japan

What you have learned

The Strategy has outperformed World equity in terms of return and at a lower volatility

‒Much due to heavy weights in gold and bonds

Increase our Bonds target weight to 25% and reduce Japan equity to 5%

‒Our primary aim is to limit the downside; therefore, we prefer defensive assets

Andrew Stotz

For more information about A.Stotz All Weather Strategy, please visit https://www.finnomena.com/port/andrew

Disclaimer

Analyst Certification

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by that analyst herein.

Required Disclosures

The analyst named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

Global Disclaimer

This report is for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein. The information contained in this report has been obtained from public sources believed to be reliable and the opinions contained herein are expressions of belief based on such information. No representation or warranty, express or implied, is made that such information or opinions is accurate, complete or verified and it should not be relied upon as such. Nothing in this report constitutes a representation that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. It is published solely for information purposes, it does not constitute an advertisement, a prospectus or other offering document or an offer or a solicitation to buy or sell any securities or related financial instruments in any jurisdiction. Information and opinions contained in this report are published for the reference of the recipients and are not to be relied upon as authoritative or without the recipient’s own independent verification or taken in substitution for the exercise of the recipient’s own judgement. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. The analyst(s) does not accept any liability whatsoever for any direct or consequential loss arising from any use of the materials contained in this report.

This report is prepared for professional investors and is being distributed to persons whose business involves the acquisition, disposal or holding of securities, whether as principal or agent.

Distribution or publication of this report in any other places to persons which are not permitted under the applicable laws or regulations of such places is strictly prohibited.